Human society is profoundly sick. In fact, it poses a threat to human beings and our physical and mental well-being. It is impossible to feel well if the society forces us to live and work in an erroneous way. Without changes to our socioeconomic structure, we can expect no fundamental changes in our lives, and Keppe’s Analytical Trilogy offers a probing analysis of economics and some solutions to our troubles. We hope what we’ve posted here will contribute significantly to helping us live in a more just, equitable and conscious society. Do let us know your thoughts.

Featured Text

Stock Market Crashes are an Important Warning Sign that the Economy is on the Wrong Track

The most dangerous economic idea for society has always been the desire to live without working either using speculative means to survive (like interest and stock investments) or relying on the privileges of birth (nobility, family wealth, etc.). In fact, this is the kind of lifestyle that causes a person to become totally alienated.

Featured Radio Program

The Stock Market Crash’s Silver Lining

Hundreds of years before the meteoric rise of Cisco Systems or Qualcomm stock prices, Semper Augustus tulip bulbs were selling for the price of a house in Holland. Tulipmania was in full swing in the 1600s, and it looked much like the dotcom madness of the 1990s. It crashed eventually, of course, but caused little lasting damage. Could the same thing be true today?

Origin of the Crisis

If you want to really know what’s going on in the economic crisis, our colleague, Gilbert Gambucci, has put together an incisive scientific dissection of the thing. Extraordinary and illuminating. Essential viewing for all of us.

Feature Video

The Decay of the U.S. and the Stock Market Crash

Stock Markets are delusional. They are propped up by fantasy money that has little intrinsic value. Speculation leads to inevitable decay as the gambling philosophy discourages productivity, jobs and development. Real growth can only come from work, not wild capital. As the richest people become richer in this bubble, nations become poorer. These social-economic systems are humankind’s greatest delusion.

Discover more Trilogical TV programs here at Trilogy Channel.

Search the entire STOP Radio Network Research Library including radio programs here.

Recommended Texts

The Dialectic: Work and Capital (A Complementary Pair)

To earn from capital without working is theft; and to work without sharing in the capital involved is slavery; in both cases, the result is an imbalance. For example, the United States became the International Bank, and allowed its industrial and agricultural productivity to fall, with the result that the nation is now in total decline.

The economy is not just a game for dozens and dozens of human beings to play at Stocks and Shares or Monopoly, with exciting peaks and troughs, living in a fantasy world. The economy is part of reality and can only be developed correctly if it returns to its true origin. It must be wedded to work, to human achievement, if peace is to return to humanity.

They first opened in 1984 in New York City, but were soon spreading to London,Stockholm, Helsinki, Lisbon and São Paulo. All of them had certain characteristics in common: financial stability and/or constant growth, satisfied workers and very happy clients and customers.

The most dangerous economic idea for society has always been the desire to live without working either using speculative means to survive (like interest and stock investments) or relying on the privileges of birth (nobility, family wealth, etc.). In fact, this is the kind of lifestyle that causes a person to become totally alienated.

Those who refuse the conscientization process, that is, who do not want to see the truth about themselves, are by the same token unwilling to put themselves into action. So what is generally called laziness is the attitude of rejecting what is good.

I was looking up synonyms for love the other day – arguably one of the most important words in the English language. As a verb, the word has about 40. Money – our topic today on Thinking With Somebody Else’s Head – has 56. (I didn’t even bother looking up “love of money”).

But whatever you call it – bucks, green, or bread – money today is so revered there’s really only one appropriate synonym … the almighty dollar.

Our topic today is an important one, and we’re going to try to look at money in ways you may not have considered before.

I’ll be talking today with Dr. Claudia Bernhardt Pacheco, a psychoanalyst and vice-president of the International Society of Analytical Trilogy in São Paulo. Our discussions today will be based on Dr. Norberto Keppe’s extraordinary book, Liberation of the People: The Pathology of Power. The book is an in depth and incisive psychological critique of money and power which reaches to the very root cause of our inverted and seriously pathological society and power structures.

Want to read more from these Trilogical Books? Visit the Book Store.

Recommended Radio Programs

It’s not the first time we’ve seen big money bailouts in our economic history, of course. Financial crises have been with us since the stock market was invented. But let’s not forget that every time the market struggles, there’s a ton of money pumped in to shore it up. Public money. But this time, there’s a lot of resistance to it. Could it be were finally waking up?

Behind the Economic Crisis II Its still hitting us hard. Markets are down, foreclosures are up. Shanty towns are springing up in southern California. Were officially in recession, it appears. And what got us here varies depending on which side of the political argument you listen to. The only problem with that is its a little difficult to get at the real root causes.

Line up all the economists in the world, it is said, and they’ll all point in different directions. And while it’s true that economists do view society through the particular lens of their political or sociological ideology, there are some general economics principles that seem widely held in the field.

One is that you can point to economic performance as an indicator of a household’s or a company’s or even a nation’s success. And therefore the need to look after the drivers of this all-important economy – banks and corporations and GDP and all that stuff.

Economic performance is even one of the most important indices when considering happiness and quality of life on those top 10 countries to live in lists that pop up once or twice a year.

But yet, there is something obviously missing in a person who gives attention only to the financial side of things in life, something out of kilter and off balance – even psychotic – in running the world based on what the bean counters have to say.

I was looking up synonyms for love the other day – arguably one of the most important words in the English language. As a verb, the word has about 40. Money – our topic today on Thinking With Somebody Else’s Head – has 56. (I didn’t even bother looking up “love of money”).

But whatever you call it – bucks, green, or bread – money today is so revered there’s really only one appropriate synonym … the almighty dollar.

Our topic today is an important one, and we’re going to try to look at money in ways you may not have considered before.

I’ll be talking today with Dr. Claudia Bernhardt Pacheco, a psychoanalyst and vice-president of the International Society of Analytical Trilogy in São Paulo. Our discussions today will be based on Dr. Norberto Keppe’s extraordinary book, Liberation of the People: The Pathology of Power. The book is an in depth and incisive psychological critique of money and power which reaches to the very root cause of our inverted and seriously pathological society and power structures.

Recommended Videos

They are propped up by fantasy money that has little intrinsic value. Speculation leads to inevitable decay as the gambling philosophy discourages productivity, jobs and development. Real growth can only come from work, not wild capital. As the richest people become richer in this bubble, nations become poorer. These social-economic systems are humankind’s greatest delusion.

There are no risks for Brazil from the current financial crisis. Actually, this situation is fortuitous for all nations that are now forced to leave speculation behind and return to work. That will bring almost immediate development. Dr. Keppe’s book, The Decay of American People and the United States, written in 1984, shows how the country has decayed and what needs to be done to reverse this. Keppe shows that those countries that stopped working and started trying to earn from gambling on the stock market are in the most trouble now. This is the single biggest cause of today’s crisis. However, this situation is apocalyptic only for speculators — not for the common person. It signals the end of the delusions principally of the First World and the sickest, most envious and voracious individuals. They need to get back to real work. In fact, there has not been a stock market crash; rather we are having our eyes opened to the nonexistence of speculative money. Brazil is not dependent on its stock market, which was actually set up to feed other countries. Brazil possesses all the necessary natural resources to experience dramatic progress. We have only to prioritize productivism instead of speculation.

The “Correct Society.” If we are conscious of problems we can correct them in a healthy manner. The society which doesn’t accept to be good, beautiful and true is in decay. Every illness stems from bad thoughts and comes from within. The three things society loves the most are the most noxious: food, money and sex. Happiness comes from the spirit. A Trilogical Idea: three independent yet interdependent powers.

Discover more Trilogical TV programs here at Trilogy Channel.

Recommended Books

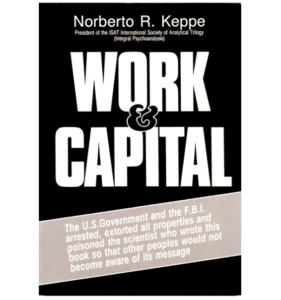

Work and Capital

Norberto R. Keppe

The author shows that the capitalist system is stuck in a dead-end, especially after John M. Keynes endorsed the thesis of speculation – as if that was the only way to save capitalism. Obviously, the so called capital has to exist, but people has to benefit from it as well – which will happen with the process of disinversion, in which all powers will start to serve the nation’s interests – differently from what is happening at the moment, where peoples from every country work for the interests of a few who have jumped over positions of power.